Have you ever thought about how cash reserves impact your ability to pay bills timely and improve your credit rating? I made an interesting discovery that taught me how cash reserves can do for financial stability what storage reservoirs do for the dependability of water systems. Let me explain how I learned this.

I live on the top of a hill and have a spring on one side of my property. Many years ago it supplied drinking water to several houses below me. When I bought the property, I had no idea the spring even existed. I certainly didn’t know that it supplied a water system I would unearth several years later. The spring is located in a wooded depression north of my house. It had been buried by decades of decaying leaves and the silt heavy rains had washed into it.

One day I was operating a small bulldozer, building trails on the twenty five wooded acres I own for my young sons to have a place to ride their dirt bikes. As I made a cut below the depression, I hit an old pipe buried in the ground. Water was seeping from it, but it was obviously not coming from an active water line. I had no idea why this water pipe was buried in my woods, but I decided to find out. I climbed up the hill to see if I could find its source.

To my surprise, less than a hundred feet up the hill I found the corner of a large concrete structure buried in the ground. By clearing the dirt from its top, I revealed a lid that covered a large access hole. Beneath the lid was a large tank partially filled with water. The pipe I had broken protruded from a spot about a foot above the bottom of the tank. A second pipe entered the tank from the upper side. It ran a few feet on up the hill to the head of a spring that had been completely filled mud and silt. When I cleaned out the spring, I saw that it flowed from under a large rock into a concrete lined bowl that was covered with a flat rock.

By cleaning out the spring a larger stream of water started to flow into the bowl. It took several minutes before the bowl filled, but when it did the water started running freely through the pipe into the storage tank. I plugged off the flow going into the pipe, dipped the water from the tank and cleaned out the mud and silt from its bottom. When I let the water flow back into the tank, it took the rest of the day for the trickle to fill it back to the point where water again flowed into the lower pipe, but there was still little more than a trickle coming from the end I had broken. I now understood how the system had been designed to work.

I cut and thread the end of the broken pipe and attached a faucet to shut off the flow of water. It took a couple of days for the tank to fill. Now when I opened the faucet, a strong stream of water gushed forth. An overflow pipe near the top of the tank kept it full and dumped excess water out onto the ground, but the volume in the tank pressurized the flow from the faucet and would provide a strong continuous flow until the tank was drained. When the faucet was closed, the trickle from the spring refilled the tank (Fig. 1).

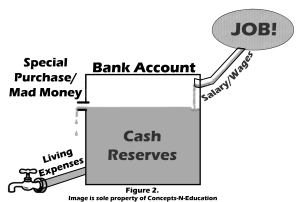

This primitive water system regulated the supply of water in very much the same way cash reserves regulate day to day finances. Think of the flow from the faucet as the daily requirement for money and the storage tank as a cash reserve (Fig. 2).

Without a storage tank (cash reserve) the flow from the faucet can never be greater than the volume coming from the spring (Fig 3). By the same token, if you spend all you make as you make it, you will never be able make large purchases or handle unexpected expenses without going in debt.

Here’s a tip! When you get paid, put part of your earnings into a savings account and live on what’s left. This regular deposit will slowly build a cash reserve that will act as a cushion to help you through tough times. It will also help you to buy some of the nicer things in life without having to resort to debt. When you spend everything you make, it would be like the people below the spring trying to live without the storage tank. They would have to go through life trying to survive on the small trickle from the spring and if drought reduced the flow, they would be forced to ask others for help.

You might think it’s difficult to save, but if you can’t do it, you’re already living above your means. You might need to temporarily lower of your standard of living in order to save, but doing so will help you avoid the burden of consumer debt. The problem is, once you start overspending, it’s easy to slip into habits that lead to financial distress or bankruptcy, which truly does ruin ones standard of living.

The old saying, “An ounce of prevention is worth a pound of cure,” is never truer than when it comes to building cash reserves. Putting aside a little from each paycheck, even $5 – $10, will gradually help you build a reserve that will enable you to pay your bills timely, strengthen your credit rating and give you peace of mind. Try it and see if it doesn’t work for you too.

Original text from article for Asheville Citizen-Times, 12th week of 2006.